HDFC Millennia Credit Card 2022

A credit card is an instrument that will enable one to make instant transactions that are based on credit. In the case of Debit cards which are linked to the respective bank accounts, where the amount will be debited from the linked account for each transaction. Whereas in the case of credit cards there will be greater flexibility for doing the transactions within the sanctioned credit limit. The credit card transactions are not linked to your bank balance, linked to the sanctioned credit limit. The transacted amount has to be repaid by the cardholder at the end of a pre-specified credit period. No transaction is allowed once the cardholder reaches the sanctioned credit limit.

HDFC Millennia Credit Card

Housing Development Finance Corporation Bank popularly known as HDFC BANK is India’s Biggest Private Sector Bank. HDFC Bank was incorporated in 1994 as a subsidiary of the Housing Development Finance Corporation, with its registered office in Mumbai, Maharashtra, India.

As one of the leading bank in India, HDFC BANK has been issuing Credit Cards for a long time. HDFC Credit Cards can be used for Shopping, Entertainment, Travelling, Bill Payments, etc.

HDFC Bank Credit Cards are designed to give the utmost safety to the customer, security, and convenience to the customer.

Types of HDFC Credit Card

There is a variety of Credit Cards offered by HDFC Bank. Customers have a wide variety and choice of credit cards. Depending upon their needs, requirements, and capacity they can choose the card that best suits their requirements. These cards have additional benefits like cashback, discounts, and rewards.

HDFC Millennia Credit Card

HDFC Millennia Credit Card is a cashback type credit card. HDFC Millennia Credit Card benefits are given below:

- 5% Cashback on Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber and Zomato

- 1% cashback on all other spends (except Fuel) including EMI & Wallet transactions

- ₹1000 worth of gift vouchers on spends of ₹1,00,000 and above in each calendar quarter

- Up to 20% discount on partner restaurants via Dineout

HDFC Millennia Credit Card Additional Features

Zero lost card liability, Upto 45 Days Interest Free Credit Period, Revolving Credit, Exclusive Dining Privileges.

HDFC Millennia Credit Card Lounge Access

HDFC Millennia Credit Card Lounge Access will be given as a complimentary to this card holder. A total of 8 Complimentary Domestic Lounge Access per calendar year will be free, additionally, Diners Club International Lounge Program is available. Swipe the Millennia Credit Card to avail yourself the complimentary lounge access. A transaction of ₹2 will be charged to the Credit Card for the Lounge Access

HDFC Millennia Credit Card Fuel Surcharge

HDFC Millennia Credit Card Fuel Surcharge feature will enable a 1% fuel surcharge waiver at all fuel stations across India for the cardholder. 1% Fuel Surcharge waiver on fuel transactions (Minimum transaction of ₹400, Maximum transaction of ₹5,000 & Maximum CashBack of ₹250 per statement cycle)

Fuel surcharge varies from 2.5% to 1% of the fuel transaction amount. The rate of

surcharge may vary depending on the fuel station and their acquiring bank.

GST is as applicable.

1000 cash points welcome benefit will be given to each cardholder. If Rs.1 lakh is spent in the preceding 12 months then the renewal membership fee will be waived. If Rs.1 Lakh or more is spent in the preceding 12 months then the renewal membership fee will be waived for next year.

Smart EMI facility, contactless payments, and Reward Point/CashBack Redemption & Validity facility is available with the HDFC Millennia Credit Card.

HDFC Millennia Credit Card Reward Points

CashBack will be given in the form of CashPoints. These cash points can be redeemed by the customer against the statement balance against a request by the customer to the bank. There is no minimum transaction value for earning CashPoints and cardholders will get

an assured reward on all transactions except fuel transactions.

- The redemption against the statement balance 1 CashPoint = ₹1

- A minimum of 500 CashPoints should be available for redemption.

- CashPoints can be used for redemption against Flight and Hotel Bookings. CashPoints can be redeemed against the Rewards Catalogue at 1 CashPoint= Rs.0.30. HDFC Millennia Credit Card Reward Points catalog will be available at HDFC SmartBuy Rewards Portal. This redemption can be done at SmartBuy Rewards Portal.

- A maximum of 50% of the booking value of the Flights and Hotels can be paid through CashPoints. The remaining 50% of the transaction amount is to be paid by credit card.

- CashPoints are to be redeemed within 2 years otherwise they will expire.

CashPoint Validity: CashBack as per product features will be credited in the form of Cash Points. CashPoints are to be redeemed within 2 years otherwise they will expire.

HDFC Millennia Credit Card Fees

HDFC Millennia Credit Card Joining/Renewal Membership Fee is Rs.1,000/- and Applicable Taxes. If the Customer spends Rs.1,00,000/- or more in a year, before the Card renewal date the renewal fee will be waived by the bank. This in turn will make the HDFC Millennia Credit Card Life Time Free without any charges for the use of this credit card.

HDFC Millennia Credit Card Interest Rate

The interest rate for the HDFC Millennia Credit Card Interest Rate per month is 3.6%. The annual Percentage Rate (APR) is 43.2%. The interest rates will be changed by Banks. Check with the bank for the latest rate of interest.

HDFC Bank Millennia Credit Card Eligibility

| Salaried | Self Employed |

|---|---|

| Indian National | Indian National |

| Age: Min 21 yrs & Max 40 Yrs, | Age: Min 21 yrs & Max 40 Yrs |

| Gross Monthly Income should be More Than Rs.35,000/- | Income Tax Return should be More Than Rs.6.0 Lakhs per Annum |

HDFC Millennia Credit Card Limit

HDFC Millennia Credit Card Limit will be decided by the HDFC Bank at its sole discretion and will be conveyed to the card member. The card members can withdraw cash up to 40% of the credit limit. The HDFC Millennia Credit Card cash withdrawal charges will be decided by the HDFC Bank and will vary from time to time. The card member has to withdraw cash only in case of emergency as the cash withdrawal charges and interest on cash withdrawal will be very high.

HDFC Millennia Credit Card Payment

The payment towards the card account can be made in various ways. The payment can be made through Net Banking, Mobile Banking, ATM, Auto Debit through Standing Instructions to the Bank, direct cash payment at bank counters, by way of Cheque/Draft, Bill desk by using other banks’ net banking account, NEFT, RTGS, IMPS. The Card Member can choose any one of the wide variety of payment options at his convenience.

HDFC Millennia Credit Card Apply

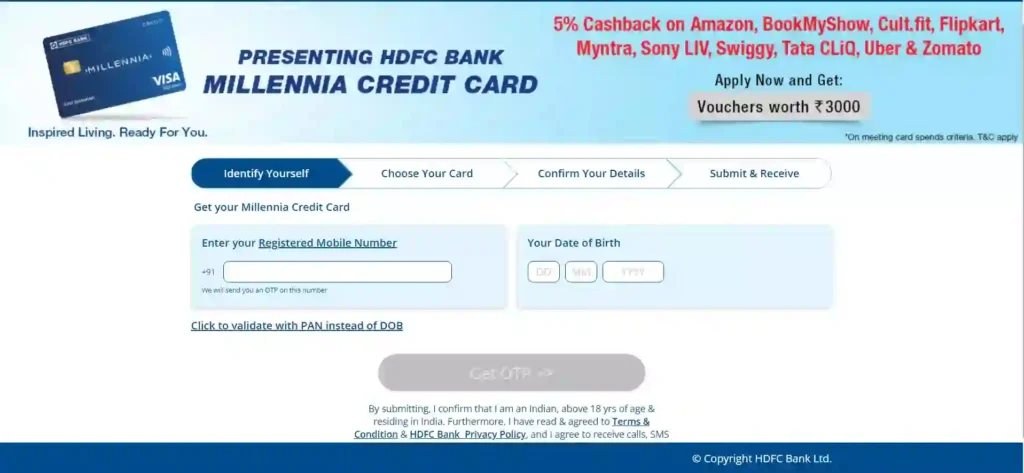

Any intended person above 18 years of age, resident Indian can apply for the HDFC Millennia Credit Card in 3 easy steps.

HDFC Millennia Credit Card Apply HERE

Enter your Mobile Number, Enter Your Date of Birth then submit to Get OTP. You will receive OTP on your mobile, then enter that OTP to validate. Then in the next step enter the Credit Card that you want to choose. In the 3rd step Confirm the entered details and Submit. In this way, the HDFC Millennia Credit Card can be applied in 3 easy steps.

HDFC Millennia Credit Card Custome Care

Contact Particulars:

The Cardmember can contact HDFC Bank Credit Cards for making any inquiries or for any grievance redressal through:

Through Call Centres:

1800 202 6161 / 1860 267 6161 If Not in India: +91 22 61606160

Through mail:

Manager, HDFC Bank Cards P.O. Box 8654, Thiruvanmiyur, Chennai – 600 041

By Email: customerservices.cards@hdfcbank.com

Grievance Redressal Official:

Phone at 04461084900 between 09.30 am to 05.30 pm Monday to Friday.

HDFC Millennia Credit Card Review

HDFC Millennia Credit Card is primarily a cash back card. Persons with a good number of transactions for shopping, dining, travel, and movie tickets will save a lot of money. 5 % cash back on 10 different online merchants, 1% cash back including transactions on EMIs, and wallet loadings will be a very good feature. Apart from this, 8 complimentary lounge access, international lounge access options, 45 days interest free period, and reward point redemption options are very attractive. The waiver of the annual fee with spending of Rs.1 Lakh is another good option. Overall HDFC Millennia Credit Card will be a worthful credit card.

FAQ

Is HDFC Millennia card free?

First Year Membership Fee – ₹1000/- + Applicable Taxes, Renewal Membership Fee – ₹1000/- + Applicable Taxes. Spend ₹1,00,000 in 12 Months and get Renewal Fee waived for the next renewal year.

What is the limit of HDFC Millennia Credit Card?

The credit limit on the HDFC Millennia Credit Card will be decided by HDFC Bank at its sole discretion. The credit limit will depend upon so many factors like the income potential of the customer, credit history, existing loans, etc. Up to 40% of the credit limit will be set as a cash withdrawal limit.

Which HDFC credit card is best Millennia or?

HDFC Millennia Credit Card is one of the Best Cash Back Credit Card in India. 5% CashBack on 10 online merchants (Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber & Zomato). 1% CashBack on all other spends (except Fuel) including EMI spends & Wallet loads. These features will benefit highly to cardholders, especially those who do a large number of transactions regularly.

What is the annual charges for HDFC Millennia credit card?

Features of HDFC Millennia Credit Card. A one-time joining fee of INR 1,000 + taxes. An annual fee or renewal fee of INR 1,000 + taxes.

How to cancel HDFC Millennia Credit Card?

HDFC Millennia Credit Card can be canceled or closed in the following ways.

Through Call Centres:

1800 202 6161 / 1860 267 6161 If Not in India: +91 22 61606160

Through mail:

Manager, HDFC Bank Cards P.O. Box 8654, Thiruvanmiyur, Chennai – 600 041

By Email: customerservices.cards@hdfcbank.com

Grievance Redressal Official:

Reach us by phone at 04461084900 between 09.30 am to 05.30 pm Monday to Friday.

HDFC Millennia Credit Card vs Regalia First which is better?

HDFC Millennia Credit Card and Regalia Firs, these two credit cards offer a wide variety of benefits to cardholders. HDFC Millennia Credit Card is primarily a cash back card and one of the best cash back card in India. HDFC Regalia mainly offers Reward points. Both cards have their own advantages and disadvantages. The consumer has to select the card based on their individual usage requirements, their spending habits, and spending amounts.

How to pay HDFC Millennia Credit Card bill?

Net Banking, Mobile Banking, through ATM, Auto Debit through Standing Instructions to the Bank, direct cash payment at bank counters, by way of Cheque/Draft, Bill desk by using other banks’ net banking account, NEFT, RTGS, IMPS.

How to apply HDFC Millennia Credit Card?

The HDFC Millennia Credit Card can be applied online in 3 simple easy steps by logging on to the official website of HDFC Bank.

Alternatively, it can be applied by visiting any of the HDFC Bank Branches in India.

How to earn reward points on HDFC Millennia Credit Card?

There is no minimum transaction value for earning CashPoints and cardholders will get an assured reward on all transactions except fuel transactions. You will get up to 45 days of the interest-free period to pay back the amount. So the card can be used for multiple shopping, purchases, paying bills, etc. which will earn reward points to the cardholder.

How to redeem HDFC Millennia Credit Card points?

CashPoints can be used for redemption against Flight and Hotel Bookings. CashPoints can be redeemed against the Rewards Catalogue at 1 CashPoint= Rs.0.30. HDFC Millennia Credit Card Reward Points catalog will be available at HDFC SmartBuy Rewards Portal. This redemption can be done at SmartBuy Rewards Portal.

How to make HDFC Millennia Credit Card lifetime free?

The Joining/Renewal Membership Fee is Rs.1,000/- and Applicable Taxes. If the Customer spends Rs.1,00,000/- or more in a year, before the Card renewal date the renewal fee will be waived by the bank. This in turn will make the HDFC Millennia Credit Card Life Time Free without any charges for the use of this credit card. If the cardholder makes every year Rs.1,00,000/- spends by using the card the renewal fee is waived and the card, in turn, will become lifetime free.

How to activate HDFC Millennia Credit Card?

The card can be activated by using any of the ATMs of HDFC Bank. ATM PIN will be sent to the registered address of the cardholder along with the credit card. The cardholder has to approach the HDFC Bank ATM to insert the card, enter the pin, and activate the card.

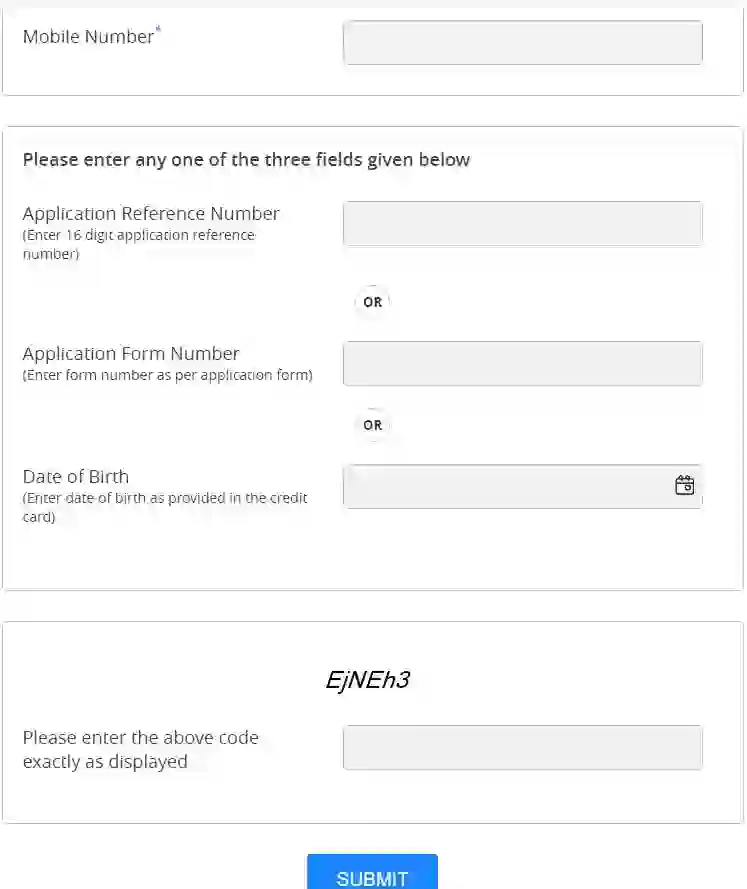

How do I check the status of the HDFC Millennia Credit Card?

One can check the status of the credit card online or offline.

Online Verification:

On submitting the application for the HDFC Millennia Credit Card, an acknowledgment message will be sent by HDFC Bank giving a reference and application number.

Confirmation SMS will be sent by HDFC Bank upon satisfying the eligibility of the applicant for issuing the card.

To check the status of your Millenia Credit Card application, you will need to check below: https://www.hdfcbank.com/personal/credit_card/cc_track.

Enter your registered mobile number and enter your 16-digit application reference number and your mobile number or date of birth. Once you enter the requested details, the status of your credit card application will be displayed to you.

Offline Verification:

Check the status Offline by calling the 24*7 customer care number.

Track your credit card by walking into the nearest HDFC Bank branch.

How to set pin for HDFC Millennia Credit Card?

The pin for the HDFC Millennia Credit Card can be set by logging into the cardholder’s HDFC Bank Net Banking Account or by using any of the HDFC Bank ATMs.

Check our other Articles/Information on Education, Jobs, and Exam Results