Post Office Sukanya Samriddhi Yojana

What is Sukanya Samriddhi Yojana

The Sukanya Samriddhi Account Scheme is the official name of one of the savings schemes of the Government of India. This scheme in India is popularly known as Sukanya Samriddhi Yojana. The Sukanya Samriddhi Account Scheme was introduced by the Government of India in the year 2014 by the then Prime Minister Mr Narendra Modiji. The main motive of this scheme is Child and Women Empowerment started under the theme “Beti Bachao Beti Phadao”. Post office Sukanya Samriddhi Yojana can be opened, operated and can be transferred to any post office in India.

The empowerment of girl child thereby empowering the women of India is the main reason behind the launching of the Sukanya Samriddhi Yojana scheme. Enhancing the savings habit in families across the country towards the welfare of the Girl Child starting from a young age is the main motive behind starting of the Post Office Sukanya Samriddhi Yojana.

Post office Sukanya Samriddhi Yojana details

In a Post Office Sukanya samriddhi yojana account, a Minimum deposit of Rs.250/- and a Maximum Amount of Rs.1.5 Lakh can be deposited in a financial year. Deposits in multiples of Rs.50/- can be made any number of times in a financial year or in a month, but the total deposited amount should not exceed Rs.1.5 Lakh. The Account can be opened in any post office in the name of a girl child till she attains the age of 10 years. Only one account can be opened in the name of a girl child.

Sukanya samriddhi Account can be opened at Post offices and in any authorised bank. The amount withdrawal is allowed for the purpose of higher education of the Account holder to meet her education expenses. The account can be prematurely closed in case of marriage of the account holder after her attaining the age of 18 years.

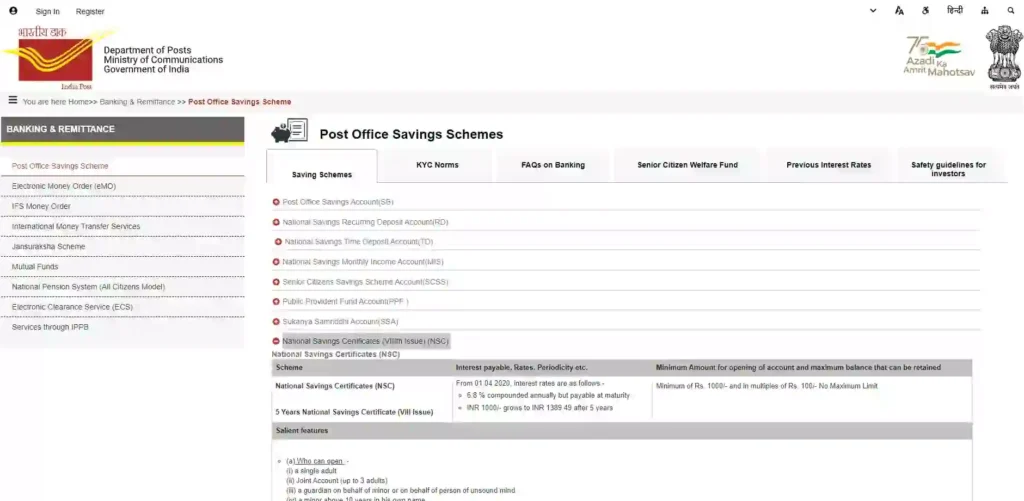

Sukanya Samriddhi Yojana official website

Sukanya Samriddhi Yojana is a central government savings scheme. The official website of this scheme is NSS India. Alternatively, the Department of Post, Government of India can be reached at India Post.

Post Office Sukanya Samriddhi Yojana Account Opening

(1) Parent or Guardian of a Girl Child can open a Post Office Sukanya Samriddhi Yojana Account. The age of the Girl Child is less than 10 years as on the date of opening of the account.

(2) Only one account can be opened in the name of a Girl Child.

(3) The Account opening Application in Form-1 is to be submitted with the Birth Certificate of the Girl Child along with the other documents of the Parent/Guardian like Aadhar Card, Pan Card, Passport size Photo

(4) An account under this Scheme may be opened for a maximum of Two Girl Children in One family.

(5) More than Two accounts are allowed in the case of birth of multiple girl children of Twins/Triplets supported by birth certificates, and affidavits by the Guardian/Parent.

Post Office Sukanya Samriddhi Yojana Interest Rate 2022

The rate of interest will be advised by the Government of India, Ministry of Finance and will be calculated Per Annum basis, compounded. Interest shall be credited at the end of the financial year. Interest earned is tax-free under Income Tax Act.

Post Office Sukanya Samriddhi Account Scheme Interest Rate Since Inception

| PERIOD | RATE OF INTEREST (%) |

| 03.12.2014 TO 31.03.2015 | 9.1 |

| 01.04.2015 TO 31.03.2016 | 9.2 |

| 01.04.2016 TO 30.09.2016 | 8.6 |

| 01.10.2016 TO 31.03.2017 | 8.5 |

| 01.04.2017 TO 30.06.2017 | 8.4 |

| 01.07.2017 TO 31.12.2017 | 8.3 |

| 01.01.2018 TO 30.09.2018 | 8.1 |

| 01.10.2018 TO 30.06.2019 | 8.5 |

| 01.07.2019 TO 31.03.2020 | 8.4 |

| 01.04.2020 TO 31.03.2022 | 7.6 |

Post Office Sukanya Samriddhi Yojana Account Opening

Offline Opening of the Sukanya Samriddhi Yojana Account

The Sukanya Samriddhi Yojana Account can be opened by approaching any post office or authorized bank in India. The duly filled-in Form-1 application along with the following documents are required for opening the Offline Sukanya Samriddhi Yojana Account.

- Birth Certificate of the Girl Child

- Aadhar Card of the Parent/Guardian

- PAN Card of the Parent/Guardian

- Address proof and KYC documents of the Parent/Guardian

How to fill Post Office Sukanya Samriddhi Yojana Form

The Sukanya Samriddhi Yojana Account can be opened in any post office or authorized bank by filling out the Form-1. Follow the detailed steps to fill Post Office Sukanya Samriddhi Yojana Form.

How to fill Post Office Sukanya Samriddhi Yojana Form.pdf Form-1

- Check the Sukanya Samriddhi Yojana Form by using the above link

- Write down the name of the post office, or branch of the bank at the top left hand side of the form.

- Paste a pass port size photograph of the Applicant girl child and Guardian on the top right hand side.

- Fill in the Name of the Girl Child on whose name the account is to be opened and the parent’s name or Guardian’s Name

- In front of the Name of the Scheme write down Sukanya Samriddhi Yojana Account

- Again write down the name of the account holder

- After Rs. enter the minimum initial deposit amount of Rs.250/- or in multiples Rs.50/- and a maximum amount of Rs.1.5 Lakh

- Tick Cash if you are paying by Cash or Write down the number of Cheque and the cheque date

- Write down the amount to be deposited in figures also

- Enter the Name of the Parent or Guardian at the Name of the first depositor at Row 1

- Enter the Date of Birth in the DD/MM/YYYY format

- Enter the Date of Birth in words also

- Leave 2,3,4 by putting a hyphen mark

- Enter the Aadhar Number of the Parent or Guardian

- Enter the PAN Number of the Parent or Guardian

- Enter the Present Address and Permanent Address of the Parent or Guardian

- Enter the contact details like phone number, mobile number, and email ID of the Parent/Guardian

- Type of Account Tick Minor and Single at Row 9

- Enter the Details of the Birth Certificate viz. Certificate Number, Date of Issue, Details of the Certificate Issuing Authority

- Enter the Name of the Parent or Guardian at Name of the Guardian at Row 11

- Enter the Aadhar and PAN of the Parent/Guardian at Row 12

- Enter the details of other KYC documents at Row 13 viz. Proof of Identification, Address proof ( 1. Passport 2. Driving license 3. Voter’s ID card 4. PAN card 5. Aadhar card 6. Job card issued by NREGA signed by the State Government officer)

- The operation of the account Tick By either of the holder/s or the surviving depositor/s at Row 14

- Enter the Name of the Account Holder and Parent / Guardian and sign above the Name at the specimen signature row

- Then sign below the declaration by the Account Holder and Parent / Guardian and sign above the Signature or thumb impression of the applicant/guardian

- Enter the date of signing

- At Row number 16 declare the details of existing accounts as on the date of signing, under different National Savings Schemes in any of the Post office/Bank in the country.

- At Row number 17 enter the nomination details. Enter the name of the account holder followed by Sukanya Samriddhi Yojana Account as the Name of the Scheme. The nominee of the Girl Child shall be the Parent/Guardian whose name was indicated in Row number 1 as the first depositor

- Enter the Name, relation with the account holder, Full Address, Aadhar number, Date of Birth of the Nominee that is Parent/Guardian, share as 100%,

- 2 persons have to sign as witnesses and their names and addresses shall be written

- Then sign below the declaration by the Account Holder and Parent / Guardian and sign above the Signature or thumb impression of the applicant/guardian

- Enter the date of signing and place

How to fill Post Office Sukanya Samriddhi Yojana Form

Online Opening of Sukanya Samriddhi Yojana Account

The Online Sunkanya Samriddhi Yojana Account can be opened in the authorized bank by logging on to the respective Bank’s internet banking. The Sukanya Samriddhi Yojana Account can be opened, Standing Instructions can be set in the net banking for the intended amount and frequency.

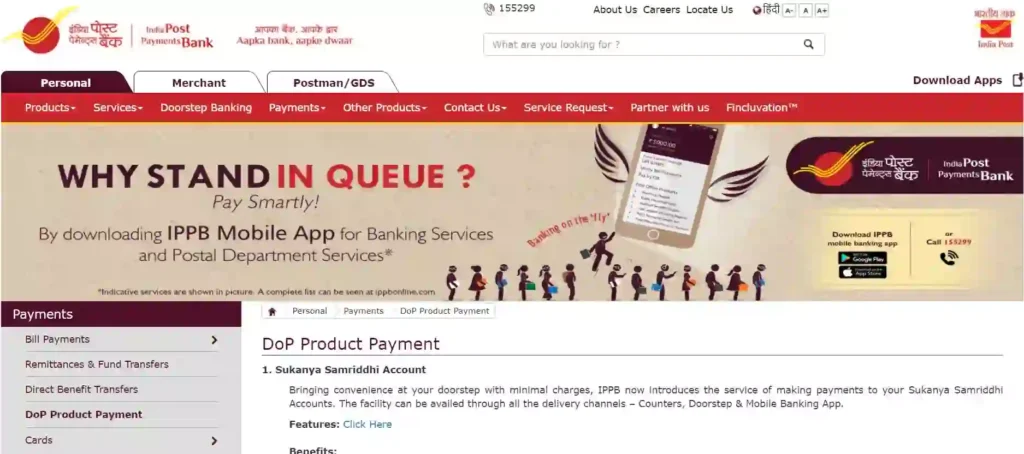

The Sunkanya Samriddhi Yojana Account has to be opened by visiting the Post Office. After the opening of the account in the Post Office, Standing Instructions can be set on the India Post Payment Bank (IPPB) App by the following sequence.

- Save the IPPB app from the Google Play Store

2. The IPPB account should have sufficient balance for the transfer

3. Navigate to Personal – Payments – DoP Product Payment. Then Select Sunkanya Samriddhi Yojana

4. Enter the SSA account number and Customer ID to set up the online payment facility

5. Select the Amount to be deposited and the frequency

6. IPPB notifies you of successful payment transfers made through IPPB mobile application

Online Opening of the Sukanya Samriddhi Yojana Account

Operation of the Post Office Sukanya Samriddhi Yojaja Account

The account shall be operated by the guardian until the Girl Child attains 18 years. On completing the 18 years the account holder can operate the account by submitting the necessary documents.

Deposits, Operation of the Post Office Sukanya Samriddhi Yojana Account

- The Post Office Sukanya Samriddhi Yojana Account may be opened with a minimum initial deposit of Rs.250/-

- Thereafter amount can be deposited in Rs.50/- or multiples of Rs.50/- any number of times in a financial year

- The minimum deposit in a financial year is Rs.250/-

- The maximum amount allowed for deposit in a financial year in one single deposit or multiple times is Rs.1.5 Lakhs

- The deposit can be made a maximum of up to 15 years from the date of opening

- If in the financial year the minimum amount of Rs.250/- is not deposited, then the account will be treated as a default

- Default account can be regularized before the completion of 15 years, by paying Rs.50/- penalty for each defaulted year along with the minimum annual deposit in respect of the defaulted years.

- If the default accounts are not regularized, then the whole deposit, including the deposits made prior to the date of default, shall be eligible for interest at the rate applicable to the Scheme till the closure of the account.

How to Withdraw Amount from Post Office Sukanya Samriddhi Yojana Account

- Application in Form-3 is to be submitted for withdrawal from the Post Office Sukanya Samriddhi Yojana Account up to a maximum of 50%. This withdrawal is allowed on the condition that the account holder has attained the age of 15 years or passed the 10th Standard whichever is earlier.

- Documentary proof shall be required for such withdrawal in the form of an admission offer for the account holder in any educational institution or course fee estimation from the institution.

- The withdrawal shall be allowed on above mentioned documentary proof in one lump sum or in instalments. Withdrawal not exceeding one per year, for a maximum of 5 years, subject to the ceiling of a maximum of 50%

Premature Closure of the Post Office Sukanya Samriddhi Yojana Account

1. On the Unfortunate Death of the Account holder. The Post Office Sukanya Samriddhi Yojana Account account will be closed on the submission of Form-2 along with the Death Certificate. Balance along with interest till the Date of Death shall be paid to the Guardian.

2. In case of extreme compassionate reasons like the amount required for life-threatening treatment of the account holder or death of the guardian. On submission of supporting documents, and on the investigation, and if satisfied with indicated reasons informed the premature closure of Sukanya Samriddhi Yojana Account will be allowed for closure.

3. In any case the account can not be closed before 5 years from the date of opening.

How to Close the Post Office Sukanya Samriddhi Yojana Account on maturity

- The Post Office Sukanya Samriddhi Yojana Account account shall mature on completion of a period of 21 years from the date of its opening.

- Before the completion of 21 years account may be allowed to be closed on the marriage of the account holder. A declaration shall be made on non-judicial stamp paper attested by the Notary supported with proof of age of not less than 18 years of age on the date of marriage.

- Provided that no such closure shall be allowed before one month from the date of the intended marriage or after three months from the date of marriage.

- On submitting the duly filled-in application in Form-4, by the account holder, the balance outstanding along with interest as applicable shall be payable to the account holder.

Conclusion

The Post office Sukanya samriddhi Yojana can be opened in any post office in India or any authorized bank branch throughout India. It’s a long term investment and savings scheme. The amount invested into this scheme either in the post office or in the bank is 100% safe and secure as it is the Government of India’s savings scheme. Post Office Sukanya Samriddhi Yojana Account can be transferred to any post office in India.

The Post office Sukanya Samriddhi Yojana’s main motive is to empower the girl child, by enhancing the savings habit of families in India thereby improving the education, and living standards of the girl child and hence empowering the women of India.

It is the best scheme for the girl child’s future, provided the parents/guardians are disciplined in investing, and savings and can wait for a longer duration without looking for withdrawals of the deposited Amount in short periods.

FAQ

How many years need to pay for Sukanya Samriddhi Yojana?

The Sukanya Samriddhi Yojana shall be operated for a minimum period of 15 years. But the maturity of the account will be 21 years minimum.

Is the maturity amount on withdrawal from the Sukanya Samriddhi Yojana account taxable?

The Post Office Sukanya Samriddhi Yojana (SSY) or Sukanya Samriddhi Yojana account comes under the EEE Benefits (triple exempt benefit). Deposit qualifies for deduction under Sec.80-C of I.T.Act. Interest earned in the account is free from Income Tax under Section 10 of I.T.Act. The maturity amount from the Sukanya Samriddhi Yojana is not taxable.

What are the eligibility criteria for the Post Office Sukanya Samriddhi Yojana (SSY)?

The SSY Account can be opened in the name of a girl child starting from her birth till she attains the age of 10.

How many accounts can be opened in Sukanya Samriddhi Yojana in one family?

A single account in the name of a girl child or 2 Accounts can be opened in the case of 2 girl children in a family. More than 2 accounts are allowed only in the case of the birth of Twins or Triplets in a family.

Who is eligible to withdraw funds from the Post office Sukanya Samriddhi Yojana account?

The girl child on attaining the age of 18 can operate the account. Before 18 years the parent or guardian only can operate the Post office Sukanya Samriddhi Yojana account.

Can I deposit more than 1.5 lakh in Sukanya Samriddhi Yojana?

No. The maximum allowed deposit amount in a financial year is Rs.1.5 Lakh in the Post office Sukanya Samriddhi Yojana account

Which scheme is best for a girl child?

Sukanya Samriddhi Yojana is the best scheme for the girl child. The main aim of this scheme is to give financial stability to the parents of the girl child at the time of girls’ peak education and marriage requirements.

What are the disadvantages of Sukanya Samriddhi Yojana?

Sukanya Samriddhi Yojana is a long term investment scheme. It is mainly intended to have the matured amount at the time of girl child education and marriage requirements.

Is Sukanya Samriddhi Yojana safe?

The amount invested in Sukanya Samriddhi Yojana is 100% safe. This is a Government of India scheme administered by the Post Offices and Authorized Banks.

Is Sukanya samriddhi Yojana Scheme tax free?

Deposit qualifies for deduction under Sec.80-C of I.T.Act. Interest earned in the account is free from Income Tax under Section -10 of I.T.Act. The maturity amount from the Sukanya Samriddhi Yojana is not taxable. Post office Sukanya Samriddhi Yojana Scheme comes under EEE benefit.

What is the Post office Sukanya samriddhi Yojana Scheme?

The Post office sukanya samriddhi Yojana Scheme account can be opened in any post office or any authorized bank in India. The account has to be opened in the name of the girl child by the parents/guardian. The account can be opened below 10 years of age of the girl child. A minimum of Rs.250/- and a maximum of Rs.1.5 Lakh can be deposited into the Sukanya samriddhi Yojana Scheme in a financial year.

What is SBI Sukanya samriddhi Yojana?

As the No.1 Bank of India, the State Bank of India is one of the authorized banks by the government of India for operating the Sukanya Samriddhi Yojana Scheme.

The SBI Sukanya samriddhi Yojana scheme features are the same as that of the Post office Sukanya samriddhi Yojana Scheme. The sukanya samriddhi Yojana Scheme facility is available at all branches of SBI. The SBI Sukanya samriddhi Yojana account can be opened by filling and submitting the Form-1 using either Cash, Cheque, Demand Draft, or Transfer/online transfers through internet banking in any branch of SBI in any part of India.

Can you consider Sukanya Samriddhi Yojana as a zero-tax saving scheme?

Sukanya Samriddhi Yojana falls under the EEE Triple benefit scheme. Under this scheme the amount invested, the interest earned, and the matured amount are exempted from tax. Hence Sukanya Samriddhi Yojana is a zero-tax saving scheme.

Check our other Articles/Information on Education, Jobs and Exam Results